Clever implementation of time recording with DATEV

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationWhat does time recording compatible with DATEV software mean?

When using a digital time recording with DATEV integration, you seamlessly transfer your wage and salary relevant data from time management directly into the software solutions DATEV LODAS as well as DATEV Lohn- und Gehalt. In addition to working hours, this also includes overtime and bonuses as well as absences such as vacation and illness. The time recording solution from ZMI has a tested DATEV interface with which you can reliably transfer the transaction data of your employees to payroll accounting. As a DATEV marketplace interface partner, ZMI is also listed on the DATEV marketplace. This offers entrepreneurs tested software solutions that perfectly match the firm’s business and accounting software.

Advantages of DATEV time recording systems

If you already use DATEV for payroll accounting in your company or your tax office uses DATEV software solutions, time recording with DATEV interface is the ideal complement. The automatic evaluation and preparation of gross wage data enables the data to be transferred digitally without the need for time-consuming manual exporting and processing. The inconvenient handling of timesheets as well as the error-prone manual transfer of data are now a thing of the past. The DATEV interface for time recording thus saves a lot of time and money on all sides.

How time recording with a DATEV interface works in practice

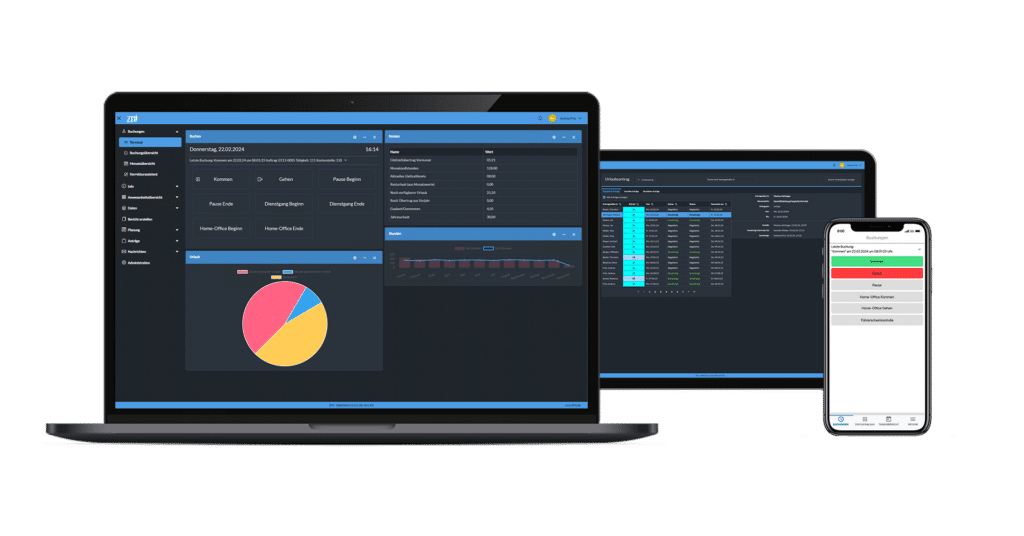

What does the use of digital time recording with DATEV interface look like in practice in your company or organization? Depending on the industry and workplace, ZMI offers different options for digitally recording working times: Employees in production or logistics record their working hours using a time recording terminal with an RFID reader or fingerprint, employees in the office or home office use the employee portal as an employee self-service and the ZMI app for iOS or Android is used at mobile workstations in the field. The recorded times are then automatically evaluated by the ZMI software and transferred to the DATEV software in your company or at your tax consultant via the DATEV wage import data service at the end of the payroll period at the push of a button.

Transfer sick notes directly from DATEV to Time & Attendance

Another advantage of digital Time & Attendance with a DATEV interface is that your employees’ electronic certificates of incapacity for work (eAU) can be retrieved from the statutory health insurance server (GKV server) and entered directly into the personnel time recording system. Digital retrieval via the DATEV wage exchange data service covers all incapacity for work supported by the eAU procedure – regardless of which software solution (DATEV LODAS or DATEV Lohn- und Gehalt) you or your tax office use for payroll accounting. In ZMI’s time recording solution, you then have a transparent overview of all eAU requests made and the corresponding feedback from the GKV server. The time-consuming manual retrieval of eAU and duplicate data maintenance in several systems is no longer necessary.

DATEV time recording with ZMI for your company

- Für alle Branchen und Unternehmensgrößen geeignet

- Digitale Erfassung von Arbeitszeiten und Auftrags-/Projektzeiten in Echtzeit

- Anbindung gängiger stationärer Erfassungshardware von Datafox, dormakaba und PCS

- Mobile Zeiterfassung über App für Android und iOS

- Urlaubsplaner und Schichtplaner

- Berechnung anfallender Zuschläge bspw. für Sonntags-, Feiertags- und Nachtarbeit

- Zahlreiche Schnittstellen für die Datenübergabe, beispielsweise in die DATEV Lohn- und Gehaltsabrechnung oder zu HRM-Systemen wie Personio

ZMI - suitable for you!

Find your individual solution in 4 steps with the help of our ZMI – Quick Check

Welche Bereiche möchten Sie digitalisieren?

Why over 1,700 customers have already chosen ZMI

Arrange a non-binding and free initial consultation now

ZMI offers you flexible solutions for recording working time. We will also find an individual solution for your company!

Would you like to call one of our experts?

Please contact us at: +49 9704 60392 – 100.